Sinclair-Cockburn Mortgage Investment Corporation Preferred A Shares

Sinclair-Cockburn Mortgage Investment Corporation (SCMIC) incorporated in 2004. SCMIC is private lender invests solely on First and Second residential mortgages. SCMIC have developed strong relationships with some of Canada’s leading banking institution. Mortgages are referred by Canadian

leading banks to SCMIC. SCMIC is related company of SCFS.

SCFS as EMD dealer is offering SCMIC preferred A shares to high net worth investors who wanted to take advantage of investing in secured conventional and non-conventional mortgages.

leading banks to SCMIC. SCMIC is related company of SCFS.

SCFS as EMD dealer is offering SCMIC preferred A shares to high net worth investors who wanted to take advantage of investing in secured conventional and non-conventional mortgages.

WHAT DOES SCMIC INVEST IN?

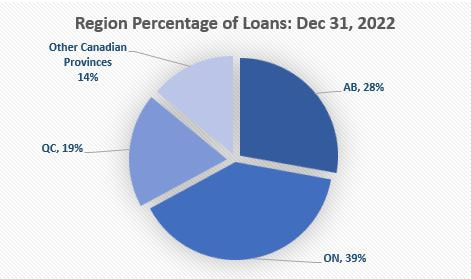

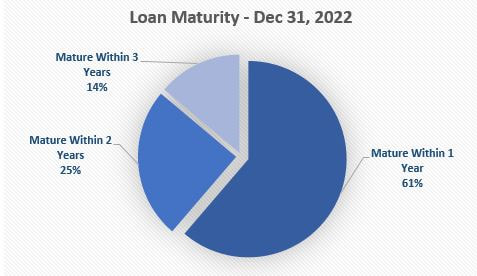

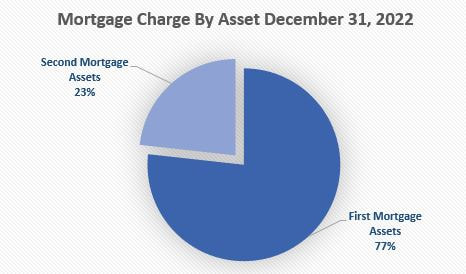

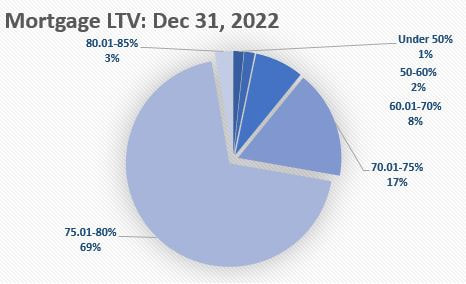

SCMIC invests in First and Second residential mortgages across Canada (all graphics below based on December 2022 data)

Maturity of the mortgages range from one to three years terms.

Percentage of First and Second residential mortgages on whole portfolio

Loan to value of the mortgages

HOW RISKY IS IT

SCMIC preferred A shares is a high-risk product with investment linked to mortgages for at least one year term. Purchaser should be aware that there are restrictions on the Purchaser’s ability to sell the purchased securities and it is the Purchaser’s responsibility to consult the Purchaser’s own advisors to

find out what those restrictions are and to comply with them before selling the Purchased Securities; and the Purchaser should be aware of the characteristics of SCMIC, the risks relating to an investment of the fact that SCMIC is not a reporting issuer in any jurisdiction and, accordingly, SCMIC are subject to an indefinite restriction on sale.

The Offered Securities are subject to restrictions on resale and the Purchaser will be restricted from selling the Purchased Securities for an indefinite period and will not be able to resell the Purchased Securities unless it complies with an exemption from the prospectus and registration requirement under applicable securities legislation.

HOW HAS SCMIC PERFORMED?

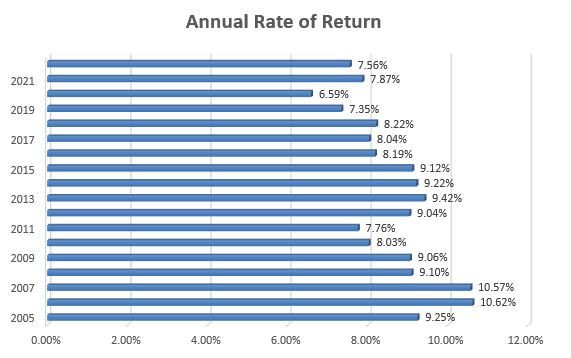

SCMIC distributes dividends to investors each quarter. The graph below shows the annual rate of return SCMIC distributes to its investors in the past 17 years.

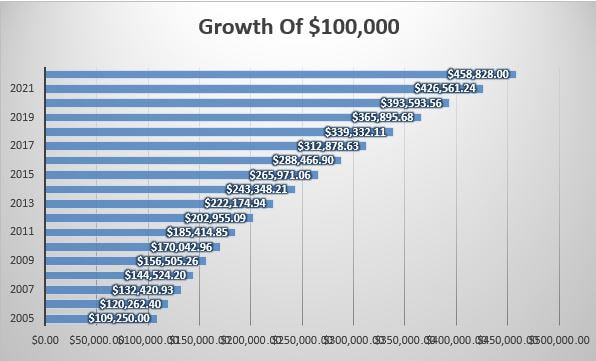

If an investor invested $100,000 since inception of SCMIC and reinvested dividend, the graph shows growth of that $100,000 investment. Compound growth calculations are used only for the purpose of illustrating the effects of compound growth and are not intended to reflect future values of SCMIC

investment or return on investment in SCMIC Preferred A shares.

investment or return on investment in SCMIC Preferred A shares.

WHO IS SCMIC FOR?

Investors who:

Plan to hold their investment for long term

Want to invest in mortgages

Can handle volatility of returns and risk on investment

Accredited investor

Not based on dividend as source of income or support in living

Good investment knowledge and high net worth investors

Plan to hold their investment for long term

Want to invest in mortgages

Can handle volatility of returns and risk on investment

Accredited investor

Not based on dividend as source of income or support in living

Good investment knowledge and high net worth investors

A WORD ABOUT TAX

SCMIC investments are eligible to invest in registered accounts, RRSP, SPRSP, RRIF, LIF. In general, investors will have to pay income tax on any dividend paid by SCMIC except in registered accounts.

HOW MUCH DOES IT COSTS?

SCFS personally own shares of SCMIC and are the Board of Directors of SCMIC. SCFS is manager of SCMIC and receives a 2.04% annual management fee for the administrative services provided to SCMIC.

Other Fees:

Finder’s Fee:

The Corporation reserves the right to pay finder's fees in an amount up to 2% of the gross proceeds of the Offering.

Short-Term trading fee:

Subject to the Business Corporations Act (Ontario), the holder of any Class “A” Share may require the Corporation to redeem (i.e. retract) such share at any time prior to the first anniversary of the date of issuance for an amount equal to its Aggregate Redemption Amount calculated as of the date of the

redemption; PROVIDED however, that the Corporation shall be entitled to three months’ advance written notice of the shareholder’s requirement for redemption and PROVIDED FURTHER that as a condition of such redemption, the Corporation shall be entitled to receive as an administrative charge of 3% of the Redemption Amount where the Class “A” Shares are redeemed prior to the first anniversary of the date of its issuance

Custodian Fee:

Investors who invest SCMIC in a registered account need to pay annual custodian fee to their Custodian Firm or Bank, and any other fees required by their Custodian such as redemption fee.

Other Fees:

Finder’s Fee:

The Corporation reserves the right to pay finder's fees in an amount up to 2% of the gross proceeds of the Offering.

Short-Term trading fee:

Subject to the Business Corporations Act (Ontario), the holder of any Class “A” Share may require the Corporation to redeem (i.e. retract) such share at any time prior to the first anniversary of the date of issuance for an amount equal to its Aggregate Redemption Amount calculated as of the date of the

redemption; PROVIDED however, that the Corporation shall be entitled to three months’ advance written notice of the shareholder’s requirement for redemption and PROVIDED FURTHER that as a condition of such redemption, the Corporation shall be entitled to receive as an administrative charge of 3% of the Redemption Amount where the Class “A” Shares are redeemed prior to the first anniversary of the date of its issuance

Custodian Fee:

Investors who invest SCMIC in a registered account need to pay annual custodian fee to their Custodian Firm or Bank, and any other fees required by their Custodian such as redemption fee.

TIME FRAME TO WITHDRAW A PURCHASE

If the purchase is rejected in whole, any payment delivered by the Investor to the Corporation on account of the subscription price for the Purchased Securities will be promptly returned to the Investor, without interest. If the Agreement is accepted only in part, payment in the amount of any excess payment delivered by the Investor to the Corporation on account of the subscription price for the Purchased Securities will be promptly delivered to the Investor, without interest.

Investor has the right to cancel purchase within 48 hours after investor received Subscription Agreement from the Corporation.

Investor has the right to cancel purchase within 48 hours after investor received Subscription Agreement from the Corporation.